Speaking of the Featheringtons (Bridgerton show on Netflix), dowries have been an important part of many cultures for years, including currently in South Asian cultures. Dowry is money, property or gift that is brought by the wife to a marriage. Parents of girls (because of the culture) put a lot of emphasis and effort on saving money for a girl's dowry, even as early as a baby girl is born. This leads to anxiety and stress (sometimes even death) especially for lower income families. That actually never made sense to me, because wealthy families often do forgo dowries, however for low-income families it's a dire obligation and requirement....though shouldn't it be the opposite? But of course that's not how our world works.

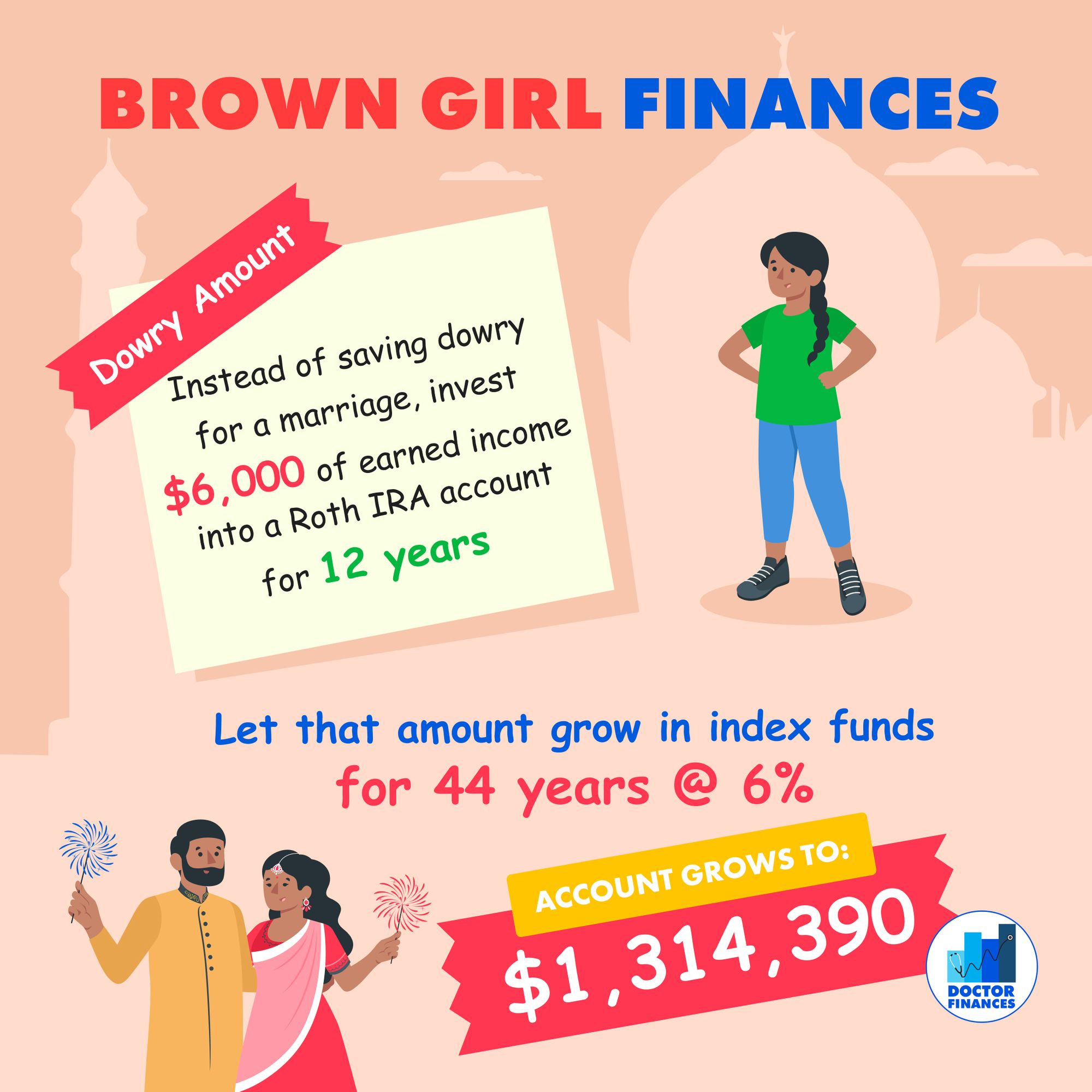

So I had a better idea, that would actually add more money to a marriage. Why not take the concept and stress of saving for a dowry and instead, have a girl (with her parents encouraging her to find a side gig, job etc she enjoys) put in $6,000 of earned income annually into a Roth IRA account at age 16 for 12 years. Say she gets married at 28 and doesn't put anymore in (she can, but let's assume she puts in only how much dowry she/parents would have saved and gifted at her wedding) and now she just holds that account for 44 or more years while married. At age 68 (retirement) that account will have grown to 1.3M of tax-free money!!! Parents can also opt to put money into a 529 account for their daughters (and sons) education at birth and have this account grow as well (529s are limited to only education expenses vs. Roth IRA which can be used for any expenses).

Let's drop old-fashioned practices that don't make a lot of mathematical sense and apply it to modern practices such as compounding growth via index funds and work towards financial independence! And yes, this can be applied to anyone - put in your earned income into a Roth IRA account, or have parents put in money into a 529 account for college, and let compound interest do it's magic!

Brown Girl Finances

-

Doctor Finances

Read more posts by this author.

Doctor Finances

• 2 min read

Subscribe to Doctor Finances

Get the latest posts delivered right to your inbox