?⚕️???Physicians, nurses and healthcare workers are holding up the medical front of the pandemic, but moms are holding up society. Most moms were already overburdened from responsibilities before the pandemic, but the pandemic has pushed it into a crisis. We need to do more to support moms because they manage families and societies, educate the next generation and basically create world peace (hello Jacinda Arden!).

?I was inspired by @reshmasaujani NYT article on moms being the bedrock of society, as well as @amy_riveter point on having affordable childcare for moms, and illustrations from #momlife from the @mavenclinic and decided to make a similar illustration for moms with a financial spin.

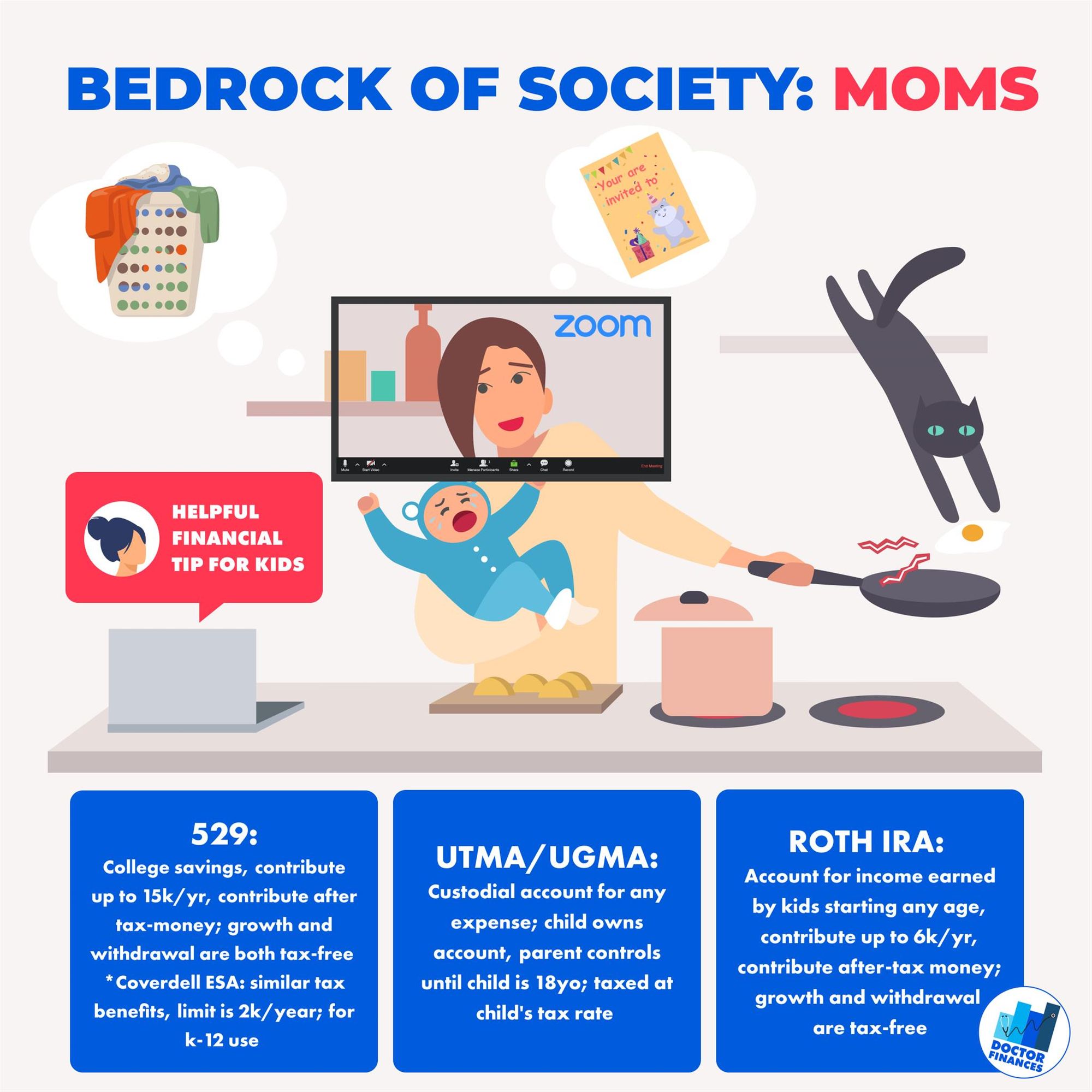

?The number #1 request for many personal finance experts and influencers is how to invest money for kids, so I made this helpful post to make it easier for moms to understand the differences between these accounts quickly. Dads are welcome to learn too ?.

?Please keep in mind, you should only contribute to these accounts after you have a sound plan for retirement (401K, tax-advantaged accounts etc.) because you can't take out loans for retirement but kids can for college. Also having an estate plan in place to designate assets and protection for your kids is an important part of financial planning.

These are the 3 major plans:

?529: College savings plan, contribute up to 15k/yr to avoid gift tax (or front-load 150k one time), you contribute after tax-money, has tax-free growth and no tax on withdrawal; you own it (not the child); some states have tax-deductions so you want to open plan with that state (state 529 website), and if no deduction available, then Utah plan has show to be best (anyone from any state can open Utah plan)

?Coverdell ESA: similar tax benefits but limit is 2k/year; K-12 use; income limit exists

?Some states such as TX & FL have amazing lock-in plans for residents; you lock-in public college tuition rates which you pay now, but kids use years later for college at locked-in rate (no worry of inflation)

UTMA/UGMA: Custodial account to pay for anything; child owns the money but parent controls it until child is 18-21yo; contribute up to 15k/yr to avoid gift tax; account is taxed at child's tax rate; you can use Vanguard to open this account

Roth IRA: Account for income earned by kids starting any age, contribute up to 6K/yr; you contribute after-tax money, has tax-free growth and tax-free on withdrawal; amount put in can be withdrawn anytime but the earnings can only be withdrawn at age 59.5; you can use Vanguard to open an account

TL;DR: for college savings, the 529 plan is the best plan to invest and grow tax-free, letting compound interest do it's magic for college tuition!

Also remember, you can purchase my bestselling kids financial workbook HERE. Best for ages 3-7 years old with lots of fun and engaging financial worksheets.