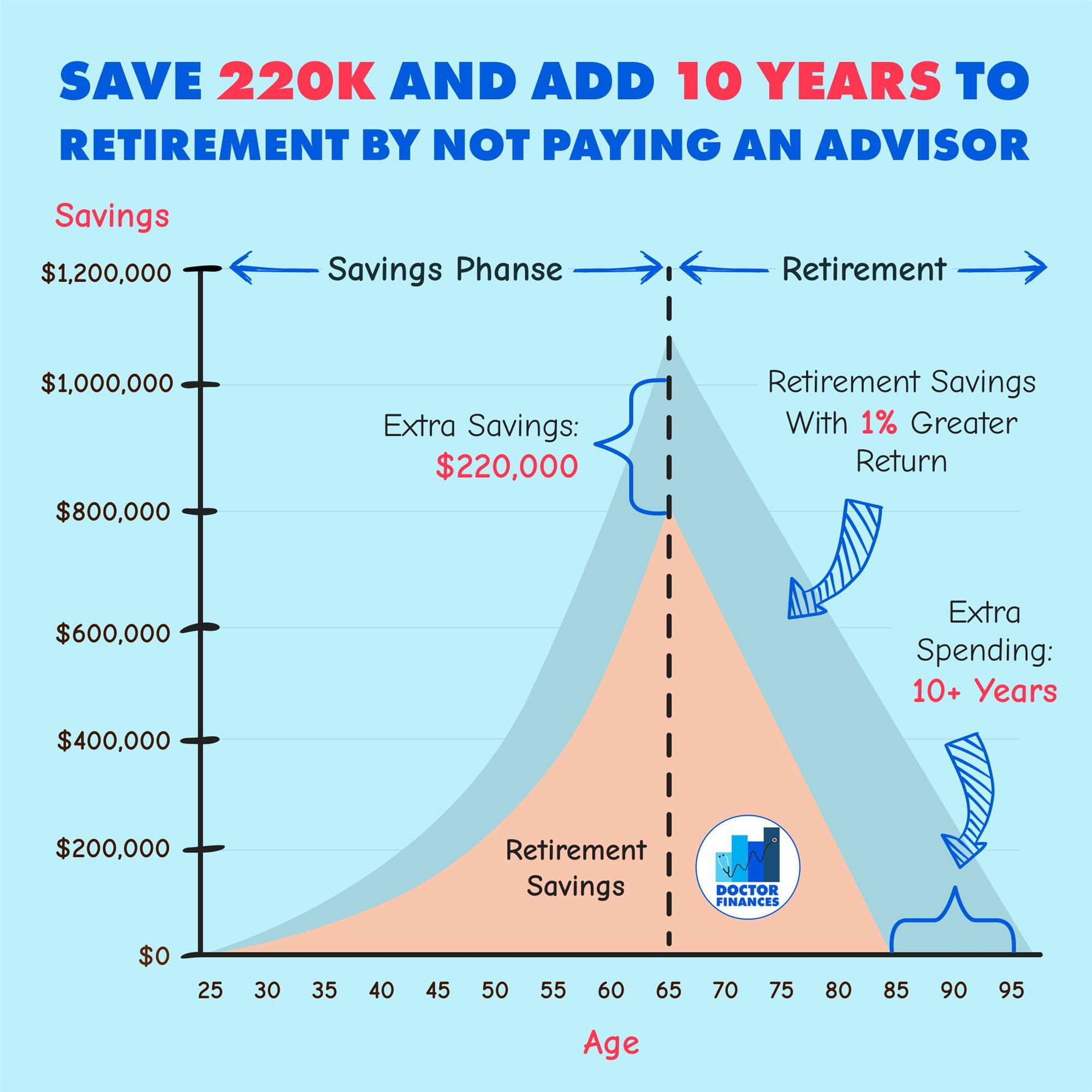

?I have seen this graph in the Bogleheads, AllianceBernstein and a few other websites floating around and wanted to share this powerful graph. By just removing 1% of AUM (assets under management) fees from paying a financial advisor or insurance agent, we can increase our networth by 220K and add 10 years of spending money! How insane is that?

?⚖️This is why I harp so much on why we should learn to invest ourselves instead of paying someone else to do it for us. The question we have to ask ourselves is, is me learning to invest worth at least 220K and ten years of financial freedom? I think the answer is yes!

?Here is the research from AllianceBerstein:

"Results are simulated. The saving phase simulates a participant with a salary of $45,000 at age 25, linearly increasing to $85,000 by age 65, making yearly contributions of 6% of salary at age 25, increasing by 0.5% per year to a maximum of 10% and with a 50% company matching contribution up to the first 6% of salary. In retirement, $63,750 (75% of final salary) is deducted at the beginning of each year. The blue-shaded area shows ending savings with an investment return of 9% assumed at age 25, linearly decreasing to 6% at age 80 and remaining constant thereafter. Inflation is assumed to be a constant 3%. The tan-shaded area assumes 1% greater return each year. All amounts are in present-day dollars."

?So don't wait to start investing - my recommendation is always low-cost and broad-based index funds through Vanguard!

?️As usual, I'm not a financial advisor and this isn't investing advice; this is educational information for all of us to learn together.

???So please take out some time this weekend, and get started on managing your personal finance or check your portfolio if anything needs to be updated! Have a great weekend everyone!

Save 220K and Add 10 Years To Retirement By Not Paying An Advisor

-

Doctor Finances

Read more posts by this author.

Doctor Finances

• 1 min read

Subscribe to Doctor Finances

Get the latest posts delivered right to your inbox