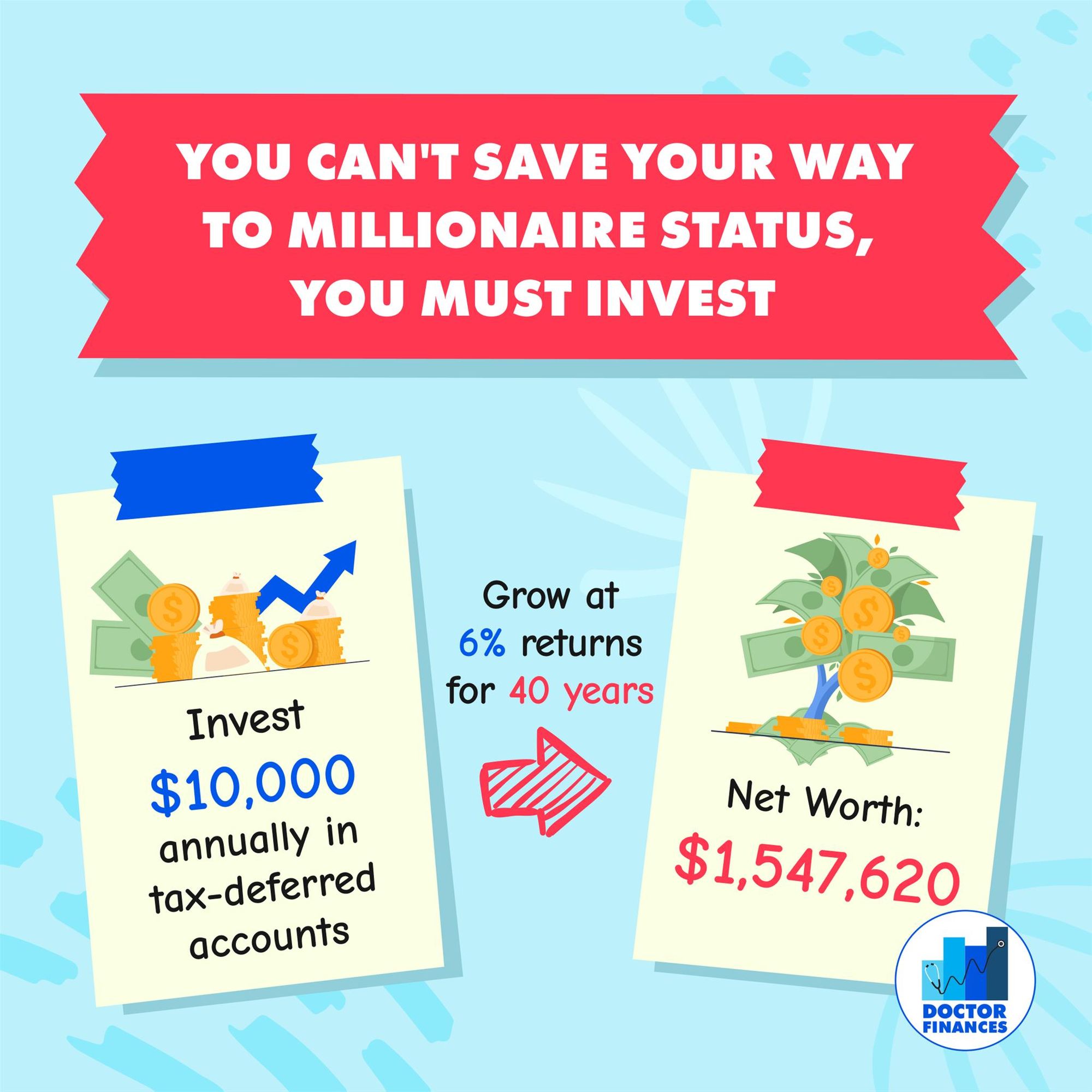

?A lot of us while growing up were told, saving money is king?. Yes, saving is important, but it must also go hand-in-hand with investing. There is something called inflation which means that there is a decrease in value of money as time progresses or as we all have experienced while shopping, a rise in price level over time. So $10K today will be worth a lot less 20 years from now. In order to fight against inflation, we have to invest our money so that it grows with the stock market. Historically, the market has always given 6-10% returns. So investing in the market is your best bet against inflation. So you have to make sure that your money is working for you in the market and not sitting around being a lazy bum in a checking or savings account and losing its value every year.

?Keep in mind, 3-6 months of emergency funds should be kept in a high-yield savings account, and any money that you need within 5 years such as the down-payment to a home should be kept in a high-yield savings account, so you have access to that money any time even if the market is down. Everything else should be invested in the market using low-cost broad-based index funds such as Vanguard's VTSAX index. Start with tax-free accounts such as 401k and Roth IRA and then to general taxable accounts, so that your money works for you and grows with the market netting you 6-10% return every year.

?And true, few people can technically save their way to $1M (or if you have a big windfall from a company you founded or a wealthy great aunt that left you a trust), but for the rest of us, saving to 1M will be very hard as we continue to fight against inflation. For the average investor, it's best to invest in the market and ease the burden of growing our wealth by letting the market do some heavy lifting for us in growing our net worth.

You Can't Save Your Way To Millionaire Status, You Must Invest

-

Doctor Finances

Read more posts by this author.

Doctor Finances

• 1 min read

Subscribe to Doctor Finances

Get the latest posts delivered right to your inbox