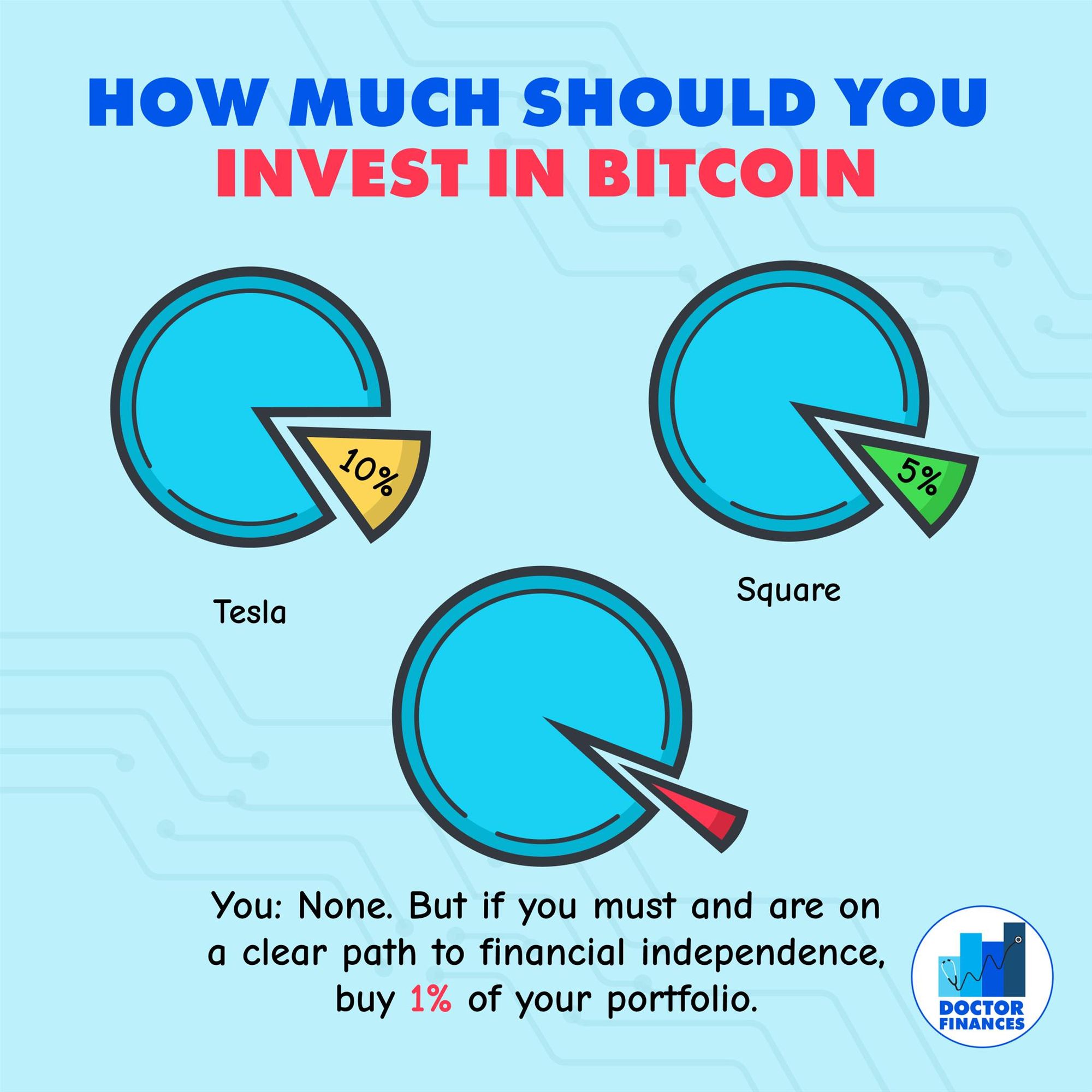

?If two billion dollar companies' bitcoin investment makes up less than 10% of their portfolio, why should ours be more? Tesla's bitcoin purchase is around 7.7% and Square's is around 5% of their portfolios.

?I read up a decent amount on bitcoin, and read the summary of "Dollar Crisis" to understand how the dollar and bitcoin can be related. But the book has some faulty logic - afterall, the value of the dollar (currency of a country) is based on the assets of the country (the people, the infrastructure etc.) not just the gold the country holds, so I'm not seeing a clear correlation of something like bitcoin to replace the dollar or how it can work together. Cryptocurrency is still the wild, wild west and everyone is taking a bet. It's not backed up by the FDIC, there are no rules or regulations, laws or courts, or anything; but Coinbase is making a lot of profit with all of the transaction fees landing Brian Armstrong in the billionaire net worth list.

?There is also a lot of scam involved with, and as I mentioned, there is no regulation. In 2014, Tokyo-based Mt. Gox, a trading platform went bankrupt and left owners looking for hundreds of thousands of bitcoin. According to the NYT, some 20% of 18.5 million bitcoin users have lost their keys or password to around $140B in those coins. As of right now, crypto is still the riskiest thing you will buy.

??Now, I totally understand the hype and curiosity. I myself purchased very little BTC and ETH (<0.1 of my portfolio) to learn and understand how Coinbase and bitcoin works so that I can learn by doing, not just reading, and already sold my BTC back. Trading or timing the market actually stresses me out. I personally like the "set it and forget it" option to index funds bc I find excitement in spending time with my kids or going to a concert, not if my stocks are going up or down.

?Now, if you must buy bitcoin because it's something new and interesting and you are emotionally fine with taking bets AND you are on a clear path to financial independence, and have maxed out all tax-advantaged accounts (accounts that have been PROVEN to work), then an article I read on CNBC recommended buying 1% of your portfolio on bitcoin. Again, all of these bitcoin numbers are all random, so this is the best number I could find.

.

And assume you already lost this money. And now if you make a lot of money off of it, then that's great, but remember, I like to talk about and emphasize things that work for the average investor, not on things because someone just got very lucky. It's hard to replicate luck, but easy to replicate historically proven stats that have worked for every average investor.

How Much Should You Invest In Bitcoin

-

Doctor Finances

Read more posts by this author.

Doctor Finances

• 2 min read

Subscribe to Doctor Finances

Get the latest posts delivered right to your inbox