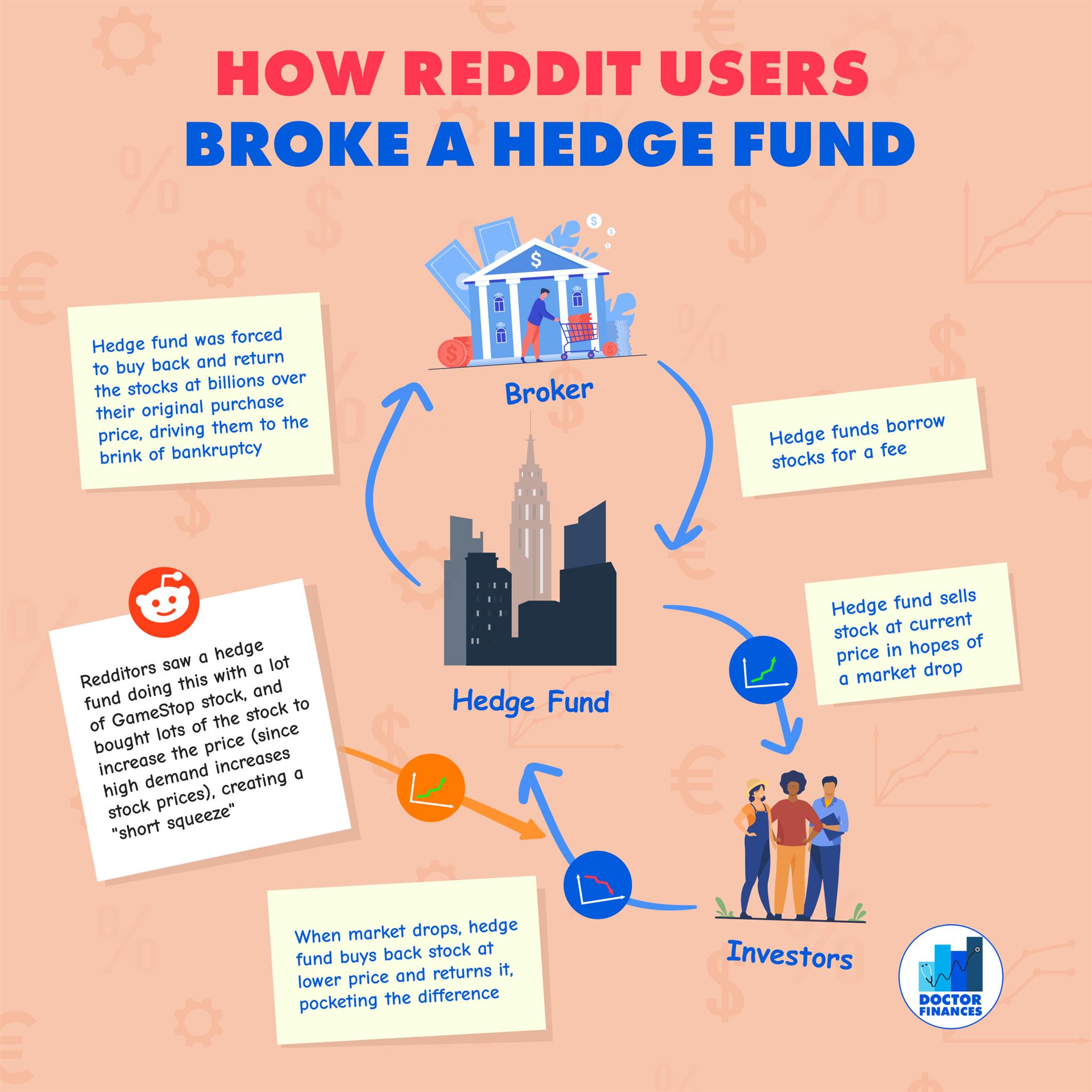

Hey Everyone, I wanted to share this illustration of what happened with Reddit users and the Melvin Capital hedge fund, and why it was so ground-breaking in stock market news.

?Typically, hedge funds borrow stocks from brokers all the time for a fee (often recurring interest), and the hedge fund plans to return the borrowed stocks after making money from it.

What the hedge fund does after borrowing the stocks, is sell the stocks to investors at the current price with hopes that stocks will fall in price (because they borrow stocks of companies they think will go down in value or fail), creating what we call short selling stocks. So for example, say they purchase the stock for $100 per share.

Next, when the stock prices drop, eg. now $70 per share, the hedge fund "covers" by buying stocks back from investors netting $30 profit per share, making billions of profit in the process.

Lastly, the hedge fund returns the borrowed stocks to the broker. Everyone is happy.

?️However, this time for the first time Reddit r/wallstreetbets users saw Melvin Capital hedge fund making massive short trades against GameStop, and decided to collectively buy lots of GameStop stocks, driving up the price of the stock, eg. now $150 per stock, creating what we call a short squeeze. So they instead drove up the stock price and forced the hedge fund to buy back shares at the higher cost to return the borrowed stocks to the broker, making them lose billions in the process and almost go into brink of bankruptcy! Pretty insane!

?Though please keep in mind as I mentioned in my previous post, buying and selling GameStop stocks is gambling. To generate wealth, the best thing to do is to buy broad-based index funds and hold for the long-term. Historically, the market has always gone up, with about average 6% returns every year and as a result, many people have successfully retired with a high net-worth.

How Reddit Users Broke a Hedge Fund

-

Doctor Finances

Read more posts by this author.

Doctor Finances

• 1 min read

Subscribe to Doctor Finances

Get the latest posts delivered right to your inbox