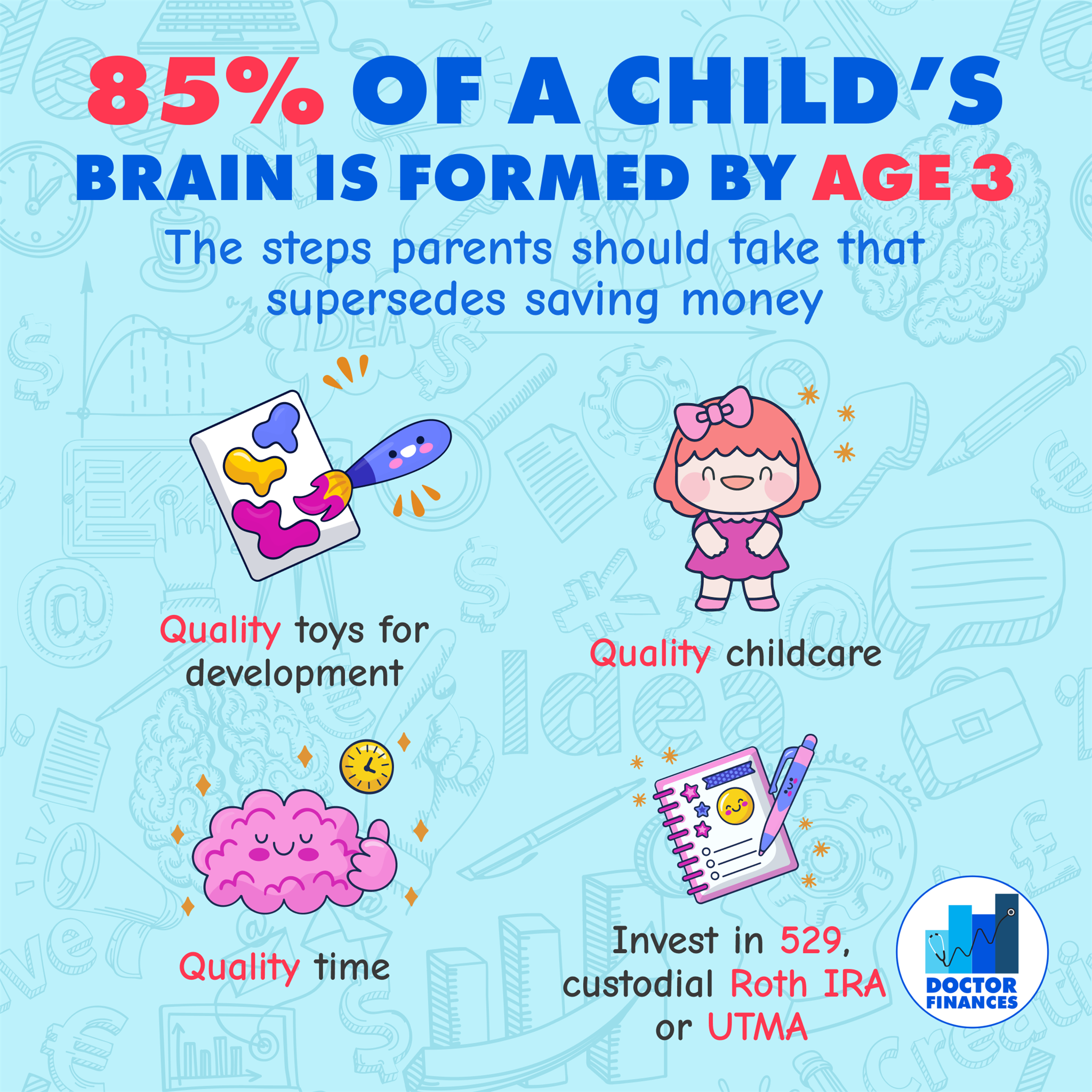

?Saving and investing is great and all, but what about when we have kids?! Everyone says they are a money pit so how do we approach that while trying to invest and grow wealth?

?First things first, with my medical background I have to point out, I made sure to look at a few journals to make sure that 85% of the brain is infact formed by age 3. According to the Journal of Comparative Neurology from research by Dr. Huttenlocher, if you look at figure 2 (I'll link it in the comments), you can see that about 85% of the prefrontal cortex is formed by 1000 days which is about 3 years of age. Essentially, the brain develops the most during the early years, and so it's important we pay attention to this.

?Hence, investing in the stock market is great but investing in our kids is more important, especially during the early years. Passing on generational wealth to them isn't going to be that helpful if they are not able to live up to their fullest potential.

So these are the things I have found to be helpful:

?1. Quality Toys: Don't go overboard, but spend money on toys and activities that are great for development. The best toy in my opinion is @magnatiles (can they sponsor me please lol) but there are many great options like train sets, walker, @melissaanddougtoys. I personally don't think wooden blocks should be the only toys kids should play with even though that seems to be a common trend now. I think a limited, quality mix of wooden and colorful toys is a great approach, and I would invest in these toys without hesitancy.

??2. Quality Childcare: Pay for quality childcare. Treat caregivers well and they will go above and beyond for your kids in return. Expense wise, this one is hard because it is a HUGE expense; it is actually my biggest expense (more than our rent per month). And there are many, many options for childcare (Au pair, preschools, nannies etc). Preschools in the Bay Area are like around 2-3k/month per child, but there are also home-based options for around $900/mo - but you should go with the one that is providing the best quality care even if it is more expensive, it is definitely worth the investment. Also, going too elite doesn't always work out either, I first enrolled Adam at a top school and it just wasn't a good fit. We ended up sending him to one that was a middle ground, play-based school and he loved it there. There is no right or wrong here, go with your gut instinct and pay for the quality care even though it hurts the bank account a bit.

?3. Quality Time: There is a money value to your time and - whether it's a working parent or stay-at-home parent, there is no such thing as "free" care because a parent's time is always valabue. But it's worth that money to spend it on our children. We can have all the care in the world, but kids still want their parents. So IF and whenever it is possible, choose time with your kids over earning more money especially when they are young (I know it's not possible for everyone, especially due to financial reasons, or deep in medical training, but whenever possible). Don't feel guilty for spending time with them, because this is an investment, just like putting money in the stock market is. And if you can't spend as much time right at this moment, that's ok too, as long as they have (no. 2) above, they will do great.

??4. Investment Accounts:Invest for them for the long-term. Technically this isn't superseding saving money because it's saving and investing, but investing in these accounts for our children is the best way to help attend college, buy supplies for school and give them a safety net to take risks with their talents and careers and to pursue what they love.