☕So how does this Roth IRA thing work and can we all become billionaires? (Short answer: no ??, but read on...)

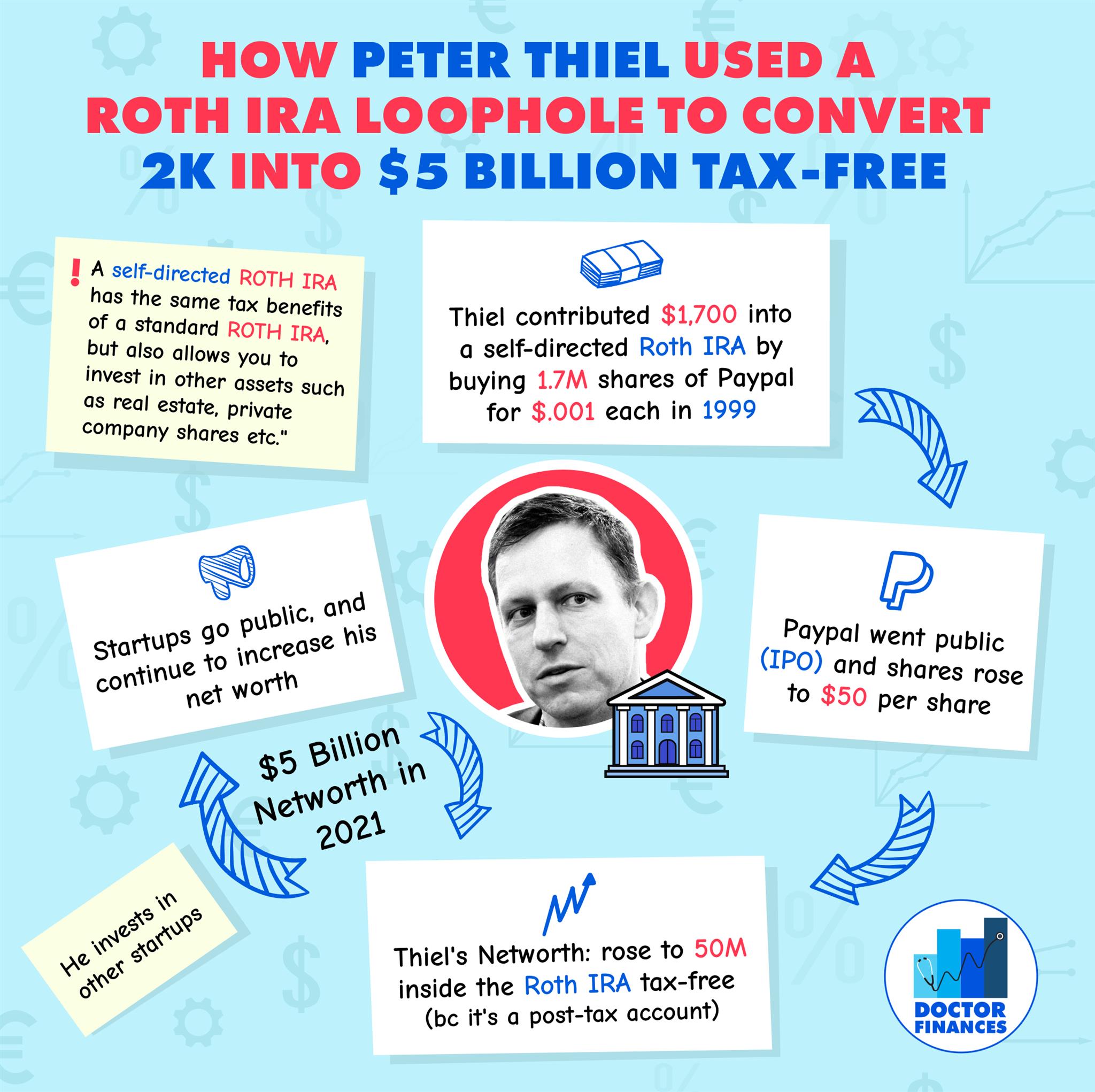

?Propublica (an investigative journal) revealed how Peter Thiel used a Roth IRA to grow $1,700 into $5B. The Roth IRA was started by Senator Roth Jr. to help hard-working, middle class Americans save for retirement. As we know, this account is amazing because we contribute post-tax money, and the money is tax-free on growth and withdrawal, and hence, there are income and contribution limits. However, there have been a few loopholes. One being the "backdoor" Roth for high-income earners (which I discussed before, scroll down) and another is the "self-directed" Roth IRA which has the same tax benefits of a standard Roth but it also allows us to invest in other asset classes such as real estate, startups etc.

?So the plus is that we all have access to this powerful account and we should all invest earned income into it (limit is 6K per year). However, can we all become billionaires using it? No. The reason is that we would have to be able to identify the next unicorn startup that will successfully IPO. Most of us can't, and infact many people do this as a living called venture capitalists and angel investors. However, I talk about this often, 90% of startups fail and most VC firms (with people working FT on deals and with access to all of the insider info) don't make money. So it's really hard for us average investors to figure out who the next winners will be.

?But why is this so upsetting if Thiel was able to identify (or got lucky) a big winner when we can't? Well, we don't particularly mind that he's earning billions because we live in a capitalist society, but what we DO mind is that the ultra-rich continue using loopholes aimed for the middle-class to avoid paying taxes! Things like this do need to change because it's really unfair and demoralizing.

?The way I see it, most of us are not trying to become billionaires or buy a yacht to sail the seven seas, but we do want to be financially independent, so in the meantime we should continue investing in our retirement accounts and work proactively towards our financial freedom!

How Peter Thiel Used A Roth IRA To Convert 2K into $5 Billion Tax-Free

-

Doctor Finances

Read more posts by this author.

Doctor Finances

• 2 min read

Subscribe to Doctor Finances

Get the latest posts delivered right to your inbox