Today we are talking about all of the accounts we can open for our (well-behaved and absolutely deserving??) children! This is a follow-up from my post a few days ago on investing for our children.

So which account is the best to open and start?

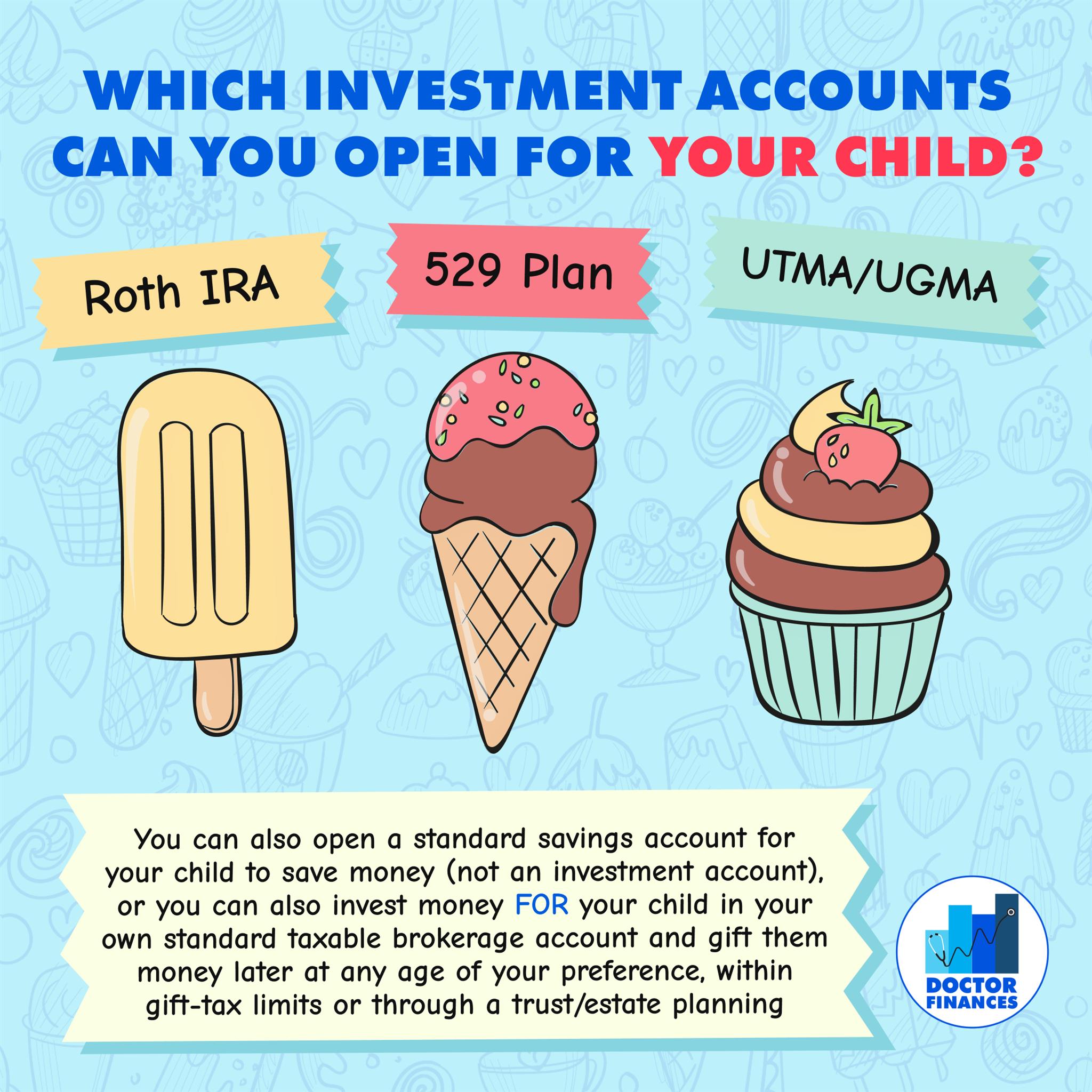

First, we have two approaches. We can either invest for them in our own investing accounts and gift them money later (following gift-tax limits), or we can open accounts on their behalf in their name that will belong to them or fund their education.

The three accounts we can open FOR them are:

?1. Roth IRA account for any income earned by them (income should be verifiable on tax forms; things such as sibling babysitting, cleaning up toys etc. doesn't qualify).

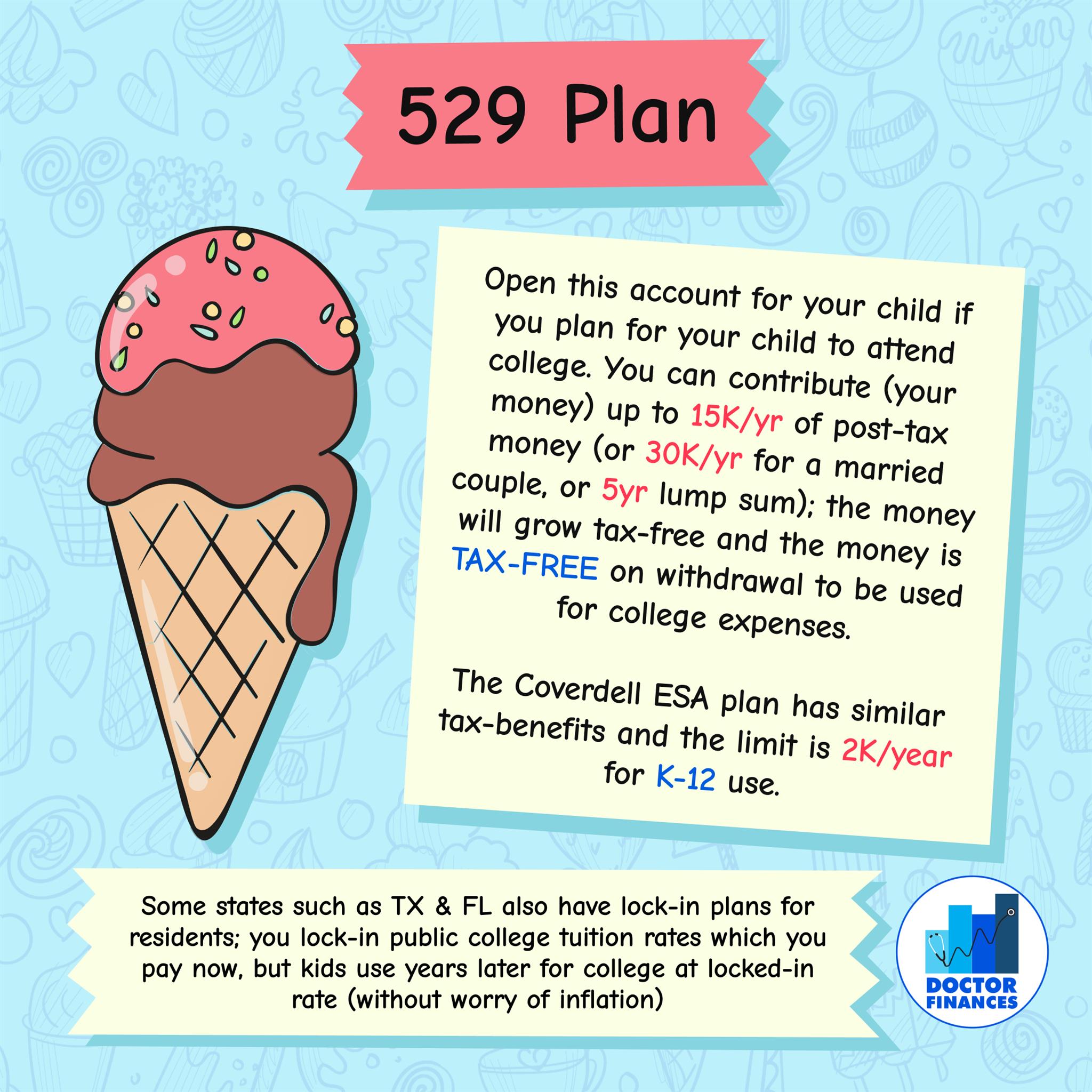

?2. The 529 account for their college savings. If your state of residence offers a tax-deduction, it's the best option, if your state doesn't, you can open an account with any state, and most recommended are Utah, Nevada or also through Wealthfront. The 529 plan is also quite flexible and can be transferred for a neice/nephew's tuition etc, so there are alot of options.

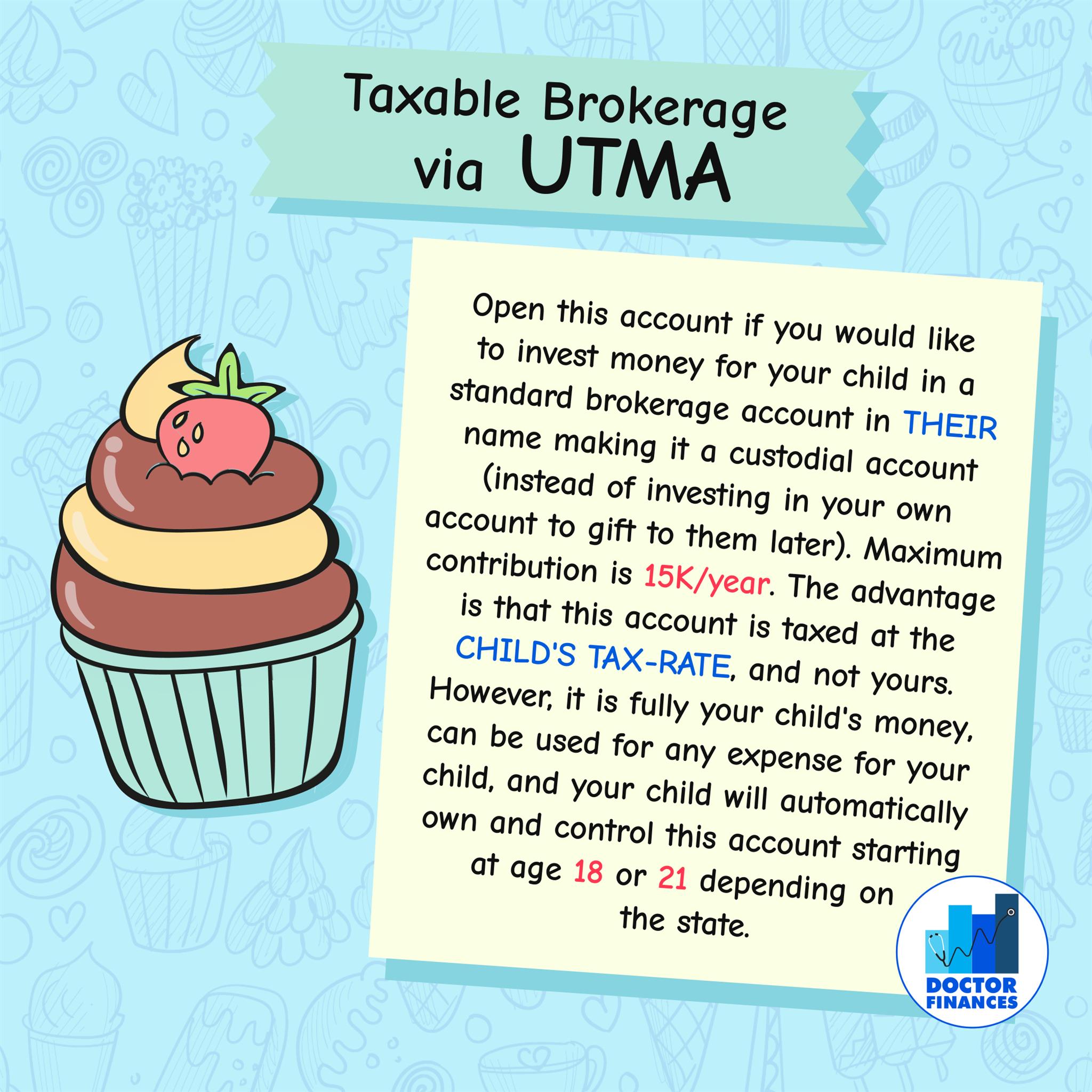

?3. A taxable brokerage via UTMA. The UTMA act (under the UGMA) was passed to allow parents/grandparents to open an account on a child's behalf. The helpful thing here is that this account will be taxed at child's tax rate (kiddie tax) removing it from parents taxable assets (esp. helpful for wealthy folks) [Note current laws for this account: First $1050 in earnings is tax-free, the next $1050 is taxable at child's tax rate and any earnings over $2100 are taxed at parents' rate] ; also this account will affect financial aid for college. Personally ?, I'm still hesitant about this account because it fully becomes under child's control at 18 or 21. If it's a small amount, it's not a big deal but if it's a lot, I'm not sure how comfortable I feel for my kids to have access to a good sum of money at such a young age. I don't want it to be a "motivation-reducer" only to save on taxes.

Hope this is helpful! I definitely went down the ??️ of information to make these slides!